A business case is essentially a cost-benefit analysis of taking a given course of action. Actions may include embarking on new projects, acquiring resources or other organizations, making non-routine purchases, adopting new methods, entering partnerships, seeking new lines of business, and so on.

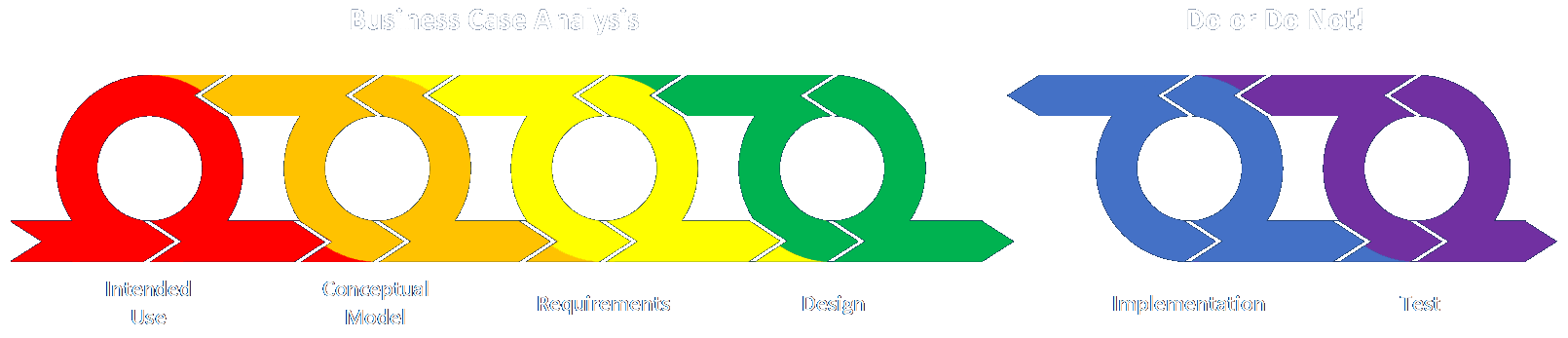

A business case may be constructed just like any other project, except the implementation and test phases aren’t part of this named effort. That is, you do everything you would normally: identify the problem, figure out what’s going on, identify needs, assess risks and constraints and assumptions, and design potential solutions. If the benefits of the solution outweigh the costs, either at all or by some specified margin, then the course of action is pursued.

The BABOK describes the process this way:

- Need Assessment: This defines some capability or improvement that may drive a benefit to the organization.

- Desired Outcomes: This is a description of the benefits realized, which can be expressed in terms of time, cost, or quality (or features).

- Analyze Alternatives: This is where you assess the costs and benefits of one or more potential solution approaches. This corresponds to the design phase of any project (possibly in conjunction with the conceptual modeling phase).

- Scope: This is where the size and boundaries of the proposed effort are determined. These define what will and will not be included in the analysis. It also helps analysts choose where to break larger problems down into smaller and more manageable ones.

- Feasibility: This analysis determines whether something can (practically) be done at all. This can be done from a technical or logistics point of view, but the major overlap is with the various financial analyses.

- Assumptions, Risks, and Constraints: I include this in my larger list of project activities, and near the beginning, but I don’t include it in the streamlined, stylized diagram of my framework. That’s because it isn’t really a standalone activity, but takes place in potentially every phase throughout the entire engagement.

- Financial Analysis and Value Assessment: This often involves a full cost-benefit analysis expressed in financial terms, but many judging and scoring systems can be used. For example, a weighted multiplicative system can allow alternatives to be compared both directly by feature and personally by perceived importance.

- Recommend Solution: Choose the best option – or not to proceed at all.