Benchmarking involves learning about activities and characteristics across industries, organizations, products, methodologies, and technologies to identify best practices, product options, and competitive requirements. Benchmarking may be performed by comparing the presence or absence of features (which video editing programs can burn to Blu-ray discs?) and also by comparing the magnitudes of various features (0-to-60 time).

The BABOK lists the following elements related to benchmarking.

- Identifying what to study

- Identifying market leaders

- Learning what others are doing

- Requesting information to learn about capabilities

- Learning during plant visits

- Performing gap analysis vs. market leaders

- Developing proposals to implement best practices

Here are some examples of benchmarking.

- When Ford released its Taurus model in 1986, winning Motor Trend’s Car of the Year Award, the design team had examined one hundred different aspects of other vehicles in its class to identify features to include and improve upon. I owned models from 1986 and 1990 and was always impressed that they included a covered storage compartment in the middle of the rear deck behind the back seat, an area which is almost always empty and neglected. I stored the car’s maintenance manuals there.

- When a company I worked for was contracted to develop a building evacuation model, I conducted an extensive online literature search to learn what work had been performed previously along those lines. I turned up numerous methodologies, research papers, case studies, modeling techniques, and more. I later listed the parameters needed to specify and control the evacuation environment and moving entities, and the user interfaces needed to define and modify them.

- The first engineering company I worked for introduced me to a really neat way of sharing information. The pulp and paper industry embodied a huge amount of empirical knowledge about the behavior and processing of wood fibers and the related equipment. My director would gather up a huge folder of reading material every two to four weeks and circulate it around to everyone in the department, complete with a checksheet to indicate that each engineer had taken the time to read through the materials. The magazines discussed some information that would more properly be considered market research, but that was a bit over my head at the time.

- Government and other (usually large) entities will sometimes issue Requests for Information (RFIs) to learn about capabilities of potential vendors, suppliers, and consultants that may be able to help them solve certain problems.

Market Analysis involves studying customers, competitors, and the market environment to determine what opportunities exist and how to address them.

The BABOK lists the following elements related to market analysis.

- Identifying customers and preferences

- Identifying opportunities to increase value

- Studying competitors and their operations

- Examining market trends in capabilities and sales

- Defining strategies

- Gathering market data

- Reviewing existing information

- Reviewing data to reach conclusions

Here are some examples of market analysis.

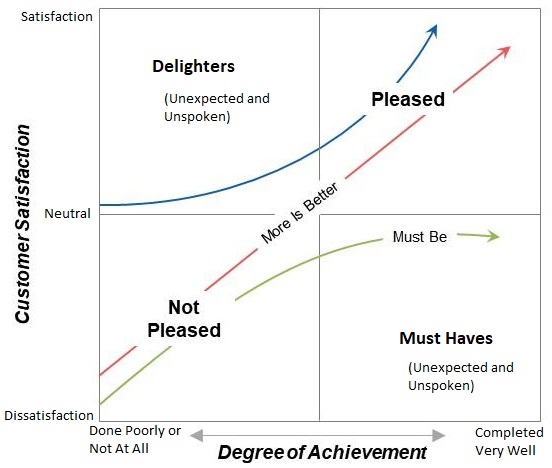

- The Kano Model of quality seeks to understand the voice of the customer (VOC). It provides a framework for measuring customer satisfaction and determining when improvement is needed. It plots features as shown below. It categorizes aspects of a product or service that are dissatisfiers, satisfiers, and delighters. Items should be prioritized by addressing dissatisfiers first, then satisfiers, and finally delighters. Think of a hotel room. Customers may expect it to be clean and have a desk and an ironing board and a blow drier, and if any of those things are missing or otherwise not right the customer will be unhappy. A hotel room is generally something where you cannot be surprised to the upside, but only to the downside. That said, free cookies, an exceptionally friendly staff, or unusually good WiFi may constitute a delighter under the right circumstances.

- The companies I worked for usually did custom consulting and product development, but I observed that we might get more financial leverage by building a standalone product we could sell many times. The company then developed such a product. Never mind that they sold all of one unit.

- The company I worked for that made HVAC controls sponsored an in-person conference with many of our customers to ask them what they most needed from us. Aside from occasional inside sales support, I usually didn’t involved in general market research.

- Costco identifies certain markets where it seeks to place new stores. As of a few years ago, they were targeting populations of a certain size, with household incomes of at least $90,000/year, with enough space to easily store large purchases of goods. They may limit their locations to be within reasonable range of their existing logistics network. The company has probably built stores in most areas that already meet their criteria, and seeks growing areas for new locations. Similarly, I’ve watched the growth of the CVS, Walgreens, and Starbucks chains over the last twenty years, and they definitely have well-established criteria for growth and expansion.

- Professional and college sports teams scout potential players from lower leagues and occasionally other sports and activities. At one time, many NFL kickers started out playing soccer (what everyone outside the US and Canada calls football).

- Students and families regularly consult many resources when selecting colleges and universities to attend, majors to pursue, the costs of doing so, and the availability of financial aid and scholarships. Of late (too late, in my opinion), more emphasis has been placed on analyzing the economic value of various degrees, to see if the value proposition makes sense for some fields.