Like the balanced scorecard technique I described yesterday, I view the business model canvas technique as a way to get analysts to look at organizations in a different way. It is used fairly commonly (though I had never seen nor heard of it prior to encountering that materials in the BABOK). It seems to me to be a tool more appropriate for higher-level officers in an organization to gain a readily accessible and somewhat standardized view of its activities, purpose, and effectiveness. That said, it’s not that business analysts cannot or should not be involved with.

While the technique seems to be primarily intended to review organizations from within, to determine the best ways to deliver value, it occurs to me that the technique could also be used to evaluate multiple organizations in a consistent way. This would provide an efficient way to compare and contrast their most salient characteristics.

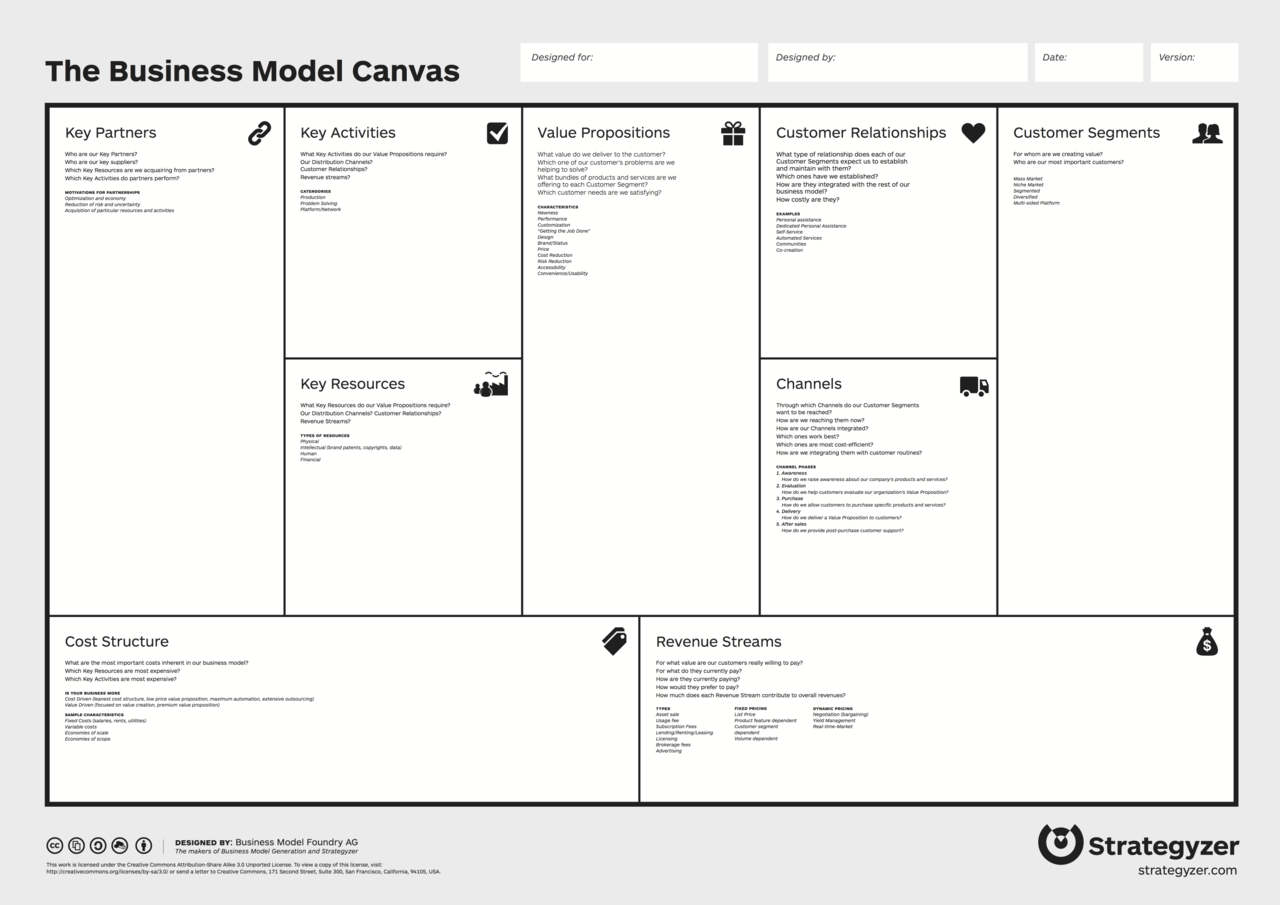

This technique is well known enough that many templates and tools exist for creating them. Here is an example from the Wikipedia entry on the technique:

The canvas contains nine sections (some versions apparently list seven), labeled per the following list, which can be filled with any kind of information that communicates in a way that all participants understand.

- Key Partnerships: What external organizations and resources, if any, enhance the organization’s ability to meet its goals?

- Key Activities: Primary activities that deliver value to customers in terms of value-add (customer willing to pay), non-value-add (customer not willing to pay), and business non-value-add (customer not willing to pay but required for other reason).

- Key Resources: Physical, financial, intellectual, and human.

- Value Proposition: What the customer pays you for (also, their cost vs. their benefit).

- Customer Relationships: Acquisition and retention, personal vs. impersonal, in-person vs. automated, etc.

- Channels: (All) Modes of interaction with the customer.

- Customer Segments: Identifying and addressing through different needs, profitability, channels, and relationship modes.

- Cost Structure: For understanding of how to manage and improve.

- Revenue Streams: All the ways to generate income and fees.